So, you want to invest for the long haul and set yourself up for success decades later? Smart thinking. With advancements in healthcare allowing people to live longer, planning for a lengthy lifespan is critical.

With the right principles guiding your investment management, you can build wealth over time and achieve financial security. In this article, we explore key principles for successful long-term investing so you can craft an investment plan to last well beyond the average lifespan. While the future may be unwritten, your financial future doesn’t have to be unknown. With prudent planning and patience, you can invest with confidence for the long term.

Long-Term Investing Helps You Plan for a 100-Year Lifespan

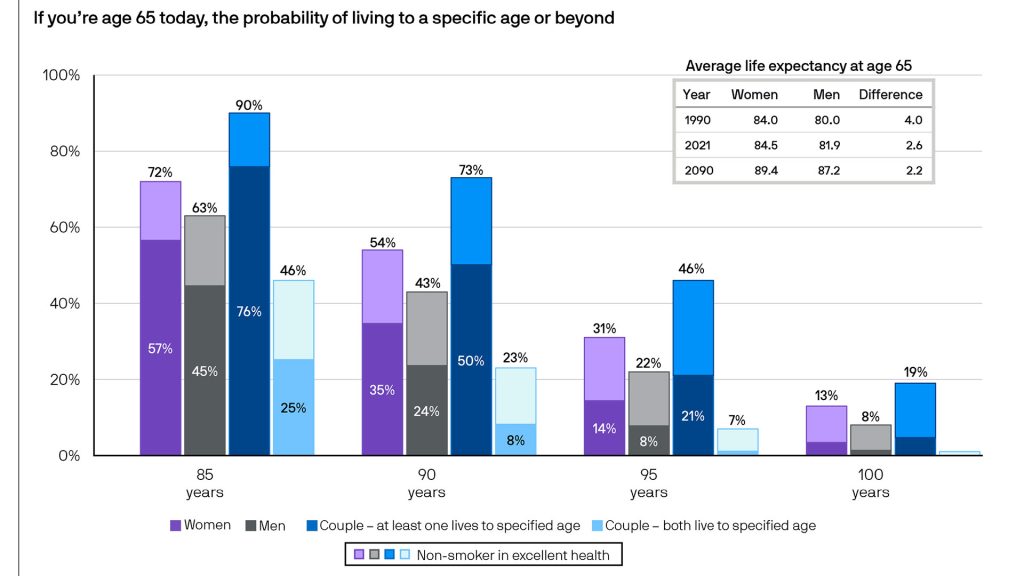

If you’re in your 20s or 30s today, there’s a good chance you’ll live to 100. (1,2) Your money may need to last 40+ years in retirement. How do you ensure it does?

First, invest for the long run. Historically, the stock market has provided positive inflation-adjusted returns over a long period. While past performance doesn’t guarantee future results, you should consider stocks for your portfolio, especially if you are decades from retirement.

Second, take advantage of compounding. Compounding happens when your investments generate returns, and those returns generate returns. When you start young, small amounts of money can grow into large sums thanks to compounding. Begin investing early and regularly to maximize the power of compounding.

Finally, diversify and rebalance. Spread your money across stocks, real estate, bonds, and cash to reduce risk. Then, rebalance periodically to maintain your target allocations as markets change. Diversification and rebalancing won’t guarantee profits or prevent losses but can help your portfolio better weather market ups and downs.

Your money can last a lifetime with a long time horizon, patience, and investment strategy. Start planning for a prosperous financial future today, and your retired self will thank you.

Don’t Hold Too Much Cash

Don’t hold excessive cash balances. While cash provides stability, inflation eats away at the purchasing power of money in the bank over time. Consider stocks and real estate, which have historically outpaced inflation. Stocks are a preferred asset class for investors seeking attractive inflation-adjusted returns.

Over 30 years, the stock market has returned an average of approximately 7% annually after inflation. That may not seem like a lot, but thanks to compounding, $10K invested in stocks today could grow to over $150K in 30 years.

Real estate can also provide positive inflation-adjusted returns. Rental property or REITs (real estate investment trusts) provide income and potential price appreciation over time. While more volatile than bonds, real estate has historically kept up with inflation and often outpaced it.

Bonds can provide income and stability. High-quality bonds like US Treasuries are low risk and yield 4.5% – 5.5% annually. Riskier high-yield corporate bonds yield approximately 8%. A balanced portfolio of stocks and bonds is a time-tested way to achieve attractive risk-adjusted returns over the long run.

Having cash for regular expenses and emergency funds is advised. However, holding too much in cash may limit your returns and wealth potential. Talk to Unify Financial Advisors about an investment mix that meets your financial goals and risk tolerance. A little volatility in the short term is often the price of achieving better long-term gains. Patience and discipline are key. Keep a long-term perspective, focus on the horizon, and don’t react to short-term market ups and downs. Your future self will thank you!

The Power of Compounding: Let Time Work Its Magic.

The power of compounding is one of the greatest benefits long-term investors have. As your money grows over time, returns start earning returns. This snowball effect means that money reinvested can accumulate into a serious nest egg.

Let’s say you invest $10,000 in the stock market, and it earns an average of 7% annually after inflation. If you withdraw the money after 20 years, you could have over $38,000. But if you leave it for 40 years, it could grow to almost $150,000. The extra time in the market led to over 3x the returns.

The more time you give your money to work, the more powerful compounding becomes. As Warren Buffett said, “My wealth has come from a combination of living in America, some lucky genes, and compound interest.”

The flip side is also true. Short-term thinking and excessive trading can negatively impact your returns over the long run. Resist the urge to react to short-term news and market swings. Time in the market, not timing the market, is the mantra of a successful long-term investor.

While there are no guarantees in the market, history has shown that staying invested is one of the greatest tools for building wealth. Keep a long-term mindset, invest regularly, and let the magic of compounding go to work for you.

Asset Allocation Matters: Balance Risks and Rewards

As an investor, allocating your assets across a diverse range of investments to balance risks and rewards is fundamental to successful investing. Diversification is achieved by investing in stocks, bonds, cash, real estate, commodities, and other investments.

DIVERSIFICATION IS KEY

Don’t put all your eggs in one basket. Allocating investments across industries, market capitalizations, and geographies can help reduce risk. For example, invest in U.S. stocks as well as international stocks. Consider owning shares of large, mid-size, and small companies and hold a mix of growth stocks and value stocks.

REBALANCE REGULARLY

Over time, the values of your investments will change, causing your portfolio allocations to shift. Rebalancing involves reducing allocations to highly appreciated assets and allocating the proceeds to new investments or those that have dropped in value. For most investors, rebalancing once a year or when allocations shift more than 5% is sufficient to achieve your target allocation.

CONSIDER YOUR RISK TOLERANCE

Your asset allocation should align with your financial goals and risk tolerance. If you have a long-time horizon, you can take on more risk for potentially higher returns. Those nearing retirement should consider revisiting their investment objectives and risk tolerance. Conservative investors might do well with 50% or more in bonds and cash, while aggressive investors could have 80% or more in stocks.

REVIEW AND REVISE

Markets and personal situations change. Review your portfolio allocation at least once a year to ensure the risks and returns meet your investment objectives. Your investment objective can change due to life events like marriage, children, new job, retirement, or other factors. An investment advisor can guide you in optimizing your asset allocation over the long run.

Following these principles will help you craft a portfolio that optimizes risks and rewards for your needs. Careful diversification, regular rebalancing, assessing your risk tolerance, and periodic reviews can set you up for investment success over the long term.

LONG-TERM INVESTING MEANS STAYING INVESTED

If there’s one principle that’s key to the success of your financial planning, it’s staying invested for the long haul. Trying to time the market by jumping in and out based on short-term predictions and emotions rarely pays off. Studies show that missing just a few of the stock market’s best days can negatively impact your returns over decades.

Rather than trying to outsmart the market, have a long-term plan and stick to it. While it can be tempting to sell when the market drops, staying invested allows you to participate when it recovers. And history shows that given enough time, markets always recover.

Dollar-cost averaging, or investing money regularly over time, helps build wealth and take advantage of market downturns. When prices are high, your money buys fewer shares, but the same amount buys more shares when prices drop. Investing often and early is one of the best strategies for building long-term wealth.

Of course, there will be market ups and downs along the way, but don’t let short-term volatility shake you. Think of investing for retirement or other long-term goals as a marathon, not a sprint. Stay focused on your destination, keep putting one foot in front of the other, and avoid making sudden turns or stopping before the finish line. Stay in it for the long haul, and keep your eye on the bigger picture.

Call Unify Financial To Build A Long Term Investing Strategy For You And Your Family Today

Successful long-term investing means making disciplined choices today to set yourself up for your desired future. It may not be the flashiest approach, but slow and steady does win the race. The rewards of long-term investing are life-changing. So, why not start now and give your future self a gift that keeps giving? You can take that first step and call Unify Financial today at (727) 306-0299 or contact us on our website here. Your future is worth it.

References.